Comparing Major S&P 500 ETF : Blackrock's IVV

- yumyums800

- Aug 28, 2023

- 2 min read

Like the previous two posts about S&P 500 ETF, I want to open the door with a short introduction of Blackrock which manages IVV.

The Genesis of Blackrock

Founded in 1988, from a small room with 8 people. Blackrock emerged from a need to provide secure and transparent asset management. Larry Fink, Rob Kapito, and other founders left the investment bank First Boston to embark on this noble journey. Little did they know, this fledgling company would evolve to become the world's largest asset manager.

The Value Proposition

Blackrock's primary distinction is its client-centric approach. They emphasize 'fiduciary duty,' ensuring that their clients' interests always come first. Leveraging cutting-edge technology, they provide unmatched clarity and insight into investments, ensuring that every decision is data-driven and sound.

Fun Facts

A Titanic Foundation - With assets under management exceeding $8 trillion by the end of 2020, if Blackrock were a country, its assets would rival the GDPs of major economies!

Not Just Equities - While Blackrock is renowned for its equity portfolios, it also manages assets ranging from real estate to renewable energy.

The Name: Ever wondered about the name 'Blackrock'? It originates from the literal meaning of “black rock” or “obsidian,” a dark, hard volcanic glass. The founders aimed to convey the firm's strength, stability, and protective essence through its nomenclature.

If you visit Blackrock's webpage, you will find the message.

Actually, It's About You

Now, let us move on to IVV - one of the major ETFs following IVV.

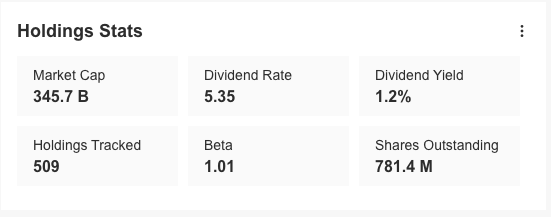

The iShares Core S&P 500 ETF, popularly known by its ticker IVV, is one of the most prominent ETFs in the financial market. Managed by Blackrock, it's designed to closely track the performance of the S&P 500 Index, which comprises 500 of the largest U.S. publicly traded companies.

Historically, IVV has demonstrated a commendable track record, largely mirroring the performance of the S&P 500. This means investors gain broad exposure to the U.S. large-cap segment. Over the years, the ETF has seen steady growth with periods of appreciation mirroring bullish markets and demonstrating resilience in downturns.

One of IVV's standout features is its low expense ratio. The expense ratio stands at 0.04%. This competitive rate underscores Blackrock's commitment to offering value to its investors, ensuring that costs are minimized. Here is the point that you may already compare the expense ratios among the three ETFs.

SPY vs VOO vs IVV - I will do summarize three ETFs in my next posts.

Dividend Yield is also one notable point. In addition to its performance, IVV is also notable for its dividends. The ETF had a dividend yield around the range of 1.3% - 1.8%. This year's dividend is 1.2%. It's essential to note that dividend yields can fluctuate based on several factors, including the performance of the constituent companies and broader market dynamics.

Now, you have three options. Which one will you pick and what would be most suitable for your trading and investment strategy?

Comments